CANCER

Counting the cost of cancer diagnosis

The significant financial burden on cancer patients and their families is vastly underestimated

May 1, 2013

-

Those dreaded words – ‘it’s cancer’ – map out an immediate future of treatment plans, hospital trips, physical endurance and a psychological adjustment that equips the patient to fight for life. But the significant out-of-pocket costs during diagnosis, treatment and follow-up care, which drain life-savings or incur additional borrowings, mean that, for many cancer patients in Ireland, fighting the disease is only half the battle.

Financial burden of diagnosis

The Irish Cancer Society (ICS) is warning that a growing number of cancer patients are struggling to meet the significant extra costs of having cancer.

Whether it’s visiting their GP or hospital doctors, lengthy hospital stays or in-home care, time off work, extra childcare costs, treatment-related travel costs, or prescription and over-the-counter medicines to help alleviate the symptoms of cancer and the side-effects of treatment, these additional expenses can accumulate at a distressing rate.

As more cancer patients find themselves in financial jeopardy as a result of their diagnosis, applications to the charity’s Financial Aid Scheme have risen by over a third (36%) in the last three years.

The Society now provides more than €1 million a year to cancer patients who need financial help, and the ICS expects this figure to rise again in 2013.

Concern is also being voiced over the psychosocial effects on cancer patients who are being pursued by debt collection agencies, hired by the HSE to chase non-payment of bills such as hospital admittance charges and chemotherapy treatment.

Patients awaiting medical cards are also being asked by the HSE to pay for chemotherapy treatment, according to the ICS.

Added anxiety

“We are hearing an increased anxiety from our callers about the cost to them of having cancer. We are giving more financial support to those who need it but we are seeing a growing number of cancer patients who are simply unable to manage the extra cost to them because they have cancer,” confirms Kathleen O’Meara, head of advocacy and communications at the Irish Cancer Society.

These stressful money worries experienced by well over half of cancer patients in Ireland is not a new development. For many years, the ICS and healthcare professionals have been aware that a cancer diagnosis is not only a health and psychological burden, but also a considerable financial drain for a large proportion of patients.

“Ten years ago people might have had some personal savings and they would have used this to help with the extra cancer-related costs or to pay household bills but, these days, people have little by way of savings and many are living week-to-week, month-to-month, or even day-to-day. When it comes to these extra costs, it’s a huge worry for them,” says specialist cancer nurse, Colette Grant, from the ICS Daffodil Centre at Cork University Hospital and the Bon Secours Hospital, Cork.

Practical support

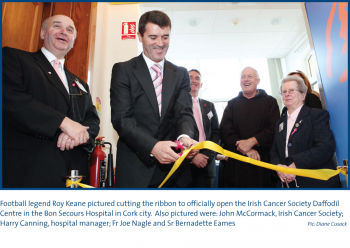

The Society currently has eight Daffodil Centres in hospitals in Cork, Dublin and Galway, which provide cancer information, support and practical advice.

Plans are at an advanced stage for four more in Letterkenny, Waterford, Limerick and St Vincent’s Hospital in Dublin over the next year, as part of an overall €3.6 million three-year investment to rollout Daffodil Centres nationwide.

“Since the Daffodil Centre opened up here in Cork in 2011, I have seen a mixture of groups who are experiencing financial hardships as a result of their cancer diagnosis; older people who have their mortgages paid off but have resolved to using their life savings to compensate the fact that the main income worker isn’t earning and, as a result of that, they find themselves with no nest egg, unable to retire, in an economy where their income isn’t as good, and they are very worried about their future.

“Then you have younger families, who obviously have very little savings because they are spending their weekly or monthly incomes on the day-to-day necessities; they are really finding it a big problem.

“Whether it’s additional heating bills as a result of having chemotherapy; additional childcare costs, having to come up to treatment once a week and putting the kids in childcare; additional petrol costs; additional dietary requirements if they need particular types of foods; and medications.

“These extra money worries are very stressful for patients who already have enough on their plate to deal with,” Colette says.

Help available

The rising number of cancer patients needing cash support for necessities prompted the Irish Cancer Society to publish a booklet on how to manage the financial impact of cancer, which gives details of social welfare supports and other benefits. It is available on the Society’s website www.cancer.ie, as are details of the Financial Aid Scheme (max once-off payment €1,000; average payout of between €350 and €500).

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)